A consistent finding from Morningstar's Global Investor Experience studies, which assess the retail investor experience across 26 markets, is that Australia has the weakest investment fund disclosure requirements on the planet. Australian investors have limited regulated rights to know what securities their funds hold in their portfolios, and required disclosures of unlisted assets—like direct property, infrastructure and private equity—are practically nonexistent.

Australia Has a Compulsory Superannuation System, and We Should Care About Portfolio Holdings Disclosures

Australia's compulsory superannuation system operates in a dark void for investors. Australians looking to invest sustainably and in line with their values have no regulatory enforced way to know if they are exposed to the debt of fossil fuel companies via their super fund. At times of market volatility, Australian investors have no regulatory enforced way to know if they are invested in overvalued private equity stocks with limited earnings, like we have recently seen with Canva. In a compulsory system where the government asks you to hand over your money, it seems absurd that there are no obligations for funds to provide detailed and timely disclosures on where this money is invested.

The Flaws in the Australian Portfolio Holdings Disclosure Regulations Are Many, but Morningstar Calls Out These Specific Points:

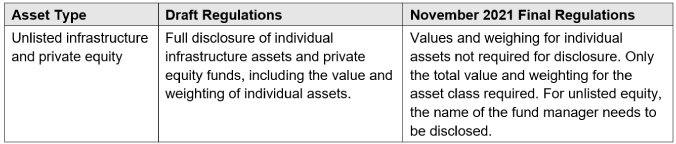

- For unlisted infrastructure, property and private equity, the values and weightings for individual assets are not required for disclosure. Only the total value and weighting for the asset class are required.

- The disclosure requirement of simple asset types like bonds is opaque, making these disclosures meaningless. Simply listing the issuer of a bond tells investors nothing about its credit quality and interest-rate risk.

- If a superannuation fund were to invest in an external bond fund, it need only disclose the name of the fund manager, obscuring whether the investment was in Australian government debt or emerging-markets bonds, and so on.

- The current regulations only require a semiannual disclosure and don't cover managed funds. Unless the fund is a related party to an Australian registrable superannuation entity and managing superannuation fund assets, there are no portfolio disclosure obligations.

- There is no way investors can use the currently required portfolios holdings data for portfolio comparison, nor is there a way to use this data to understand the true risks of a portfolio.

Investor Benefits From Change

- Australians looking to invest sustainably would have clear visibility of what assets their funds are holding and whether these holdings are in line with their values.

- More-granular disclosures and identifiers would allow portfolio constructors to conduct deeper analysis to better support end investors in reaching their investment goals. There is no way that individuals or groups could identify fraudulent activities using the currently required portfolio disclosures.

Following industry lobbying, draft regulations to require disclosure of the values and weightings of individual assets were significantly watered down in November 2021, so that the regulated disclosures for derivatives and unlisted assets are only required on an aggregate basis. Individual attributes for derivatives and specific dollar values for individual unlisted property, infrastructure, and private equity assets are not required.

Morningstar finds industry arguments for the need for confidentiality around unlisted assets to be unpersuasive, particularly when you compare the transparency that investors received for direct property in the Australian Real Estate Investment Trust sector.

Australia's current portfolio holdings regulations offer little value to Australian investors and do not exceed the lowest bar that Morningstar sees in disclosure regulations in other global markets. In Australia's compulsory superannuation system, investors' best interests are not being served by weak portfolio holdings disclosure regulations.

©2022 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information refer to our Financial Services Guide (AU) and Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/mca/s/fapds.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.