Greenwashing is currently front and centre in Australia as regulators flex their muscles, according to Morningstar's analysis, which highlights how Vanguard was fined by ASIC for not delivering the full extent of promised exclusions outlined in their Product Disclosure Statement.

Ironically, this case was based on a technicality, according to the report.

The latest development in greenwashing enforcement is ASIC’s federal court claim against Mercer Superannuation Ltd over alleged greenwashing of fossil fuels, alcohol, and gambling. The regulator claims that Mercer invested in businesses exposed to these industries while professing to exclude these industries from some of its sustainable investment options.

It will be interesting to see how this case plays out as it will serve as a precedent for others, Hall's report notes.

These cases follow ASIC’s intention, flagged back in 2022, to review investment funds and determine whether they live up to their green claims. The Australian Competition and Consumer Commission, also flagged that it would be focusing on environmental, social, and governance claims under Australian Consumer Law.

Greenwashing Is an Insidious Scourge

Greenwashing is an insidious scourge on sustainable investing—at its worst it siphons away capital from genuinely green strategies, and the practice is corrosive to long-term trust and credibility. In fact, both ASIC and ACCC have identified greenwashing as amongst their highest enforcement priorities.

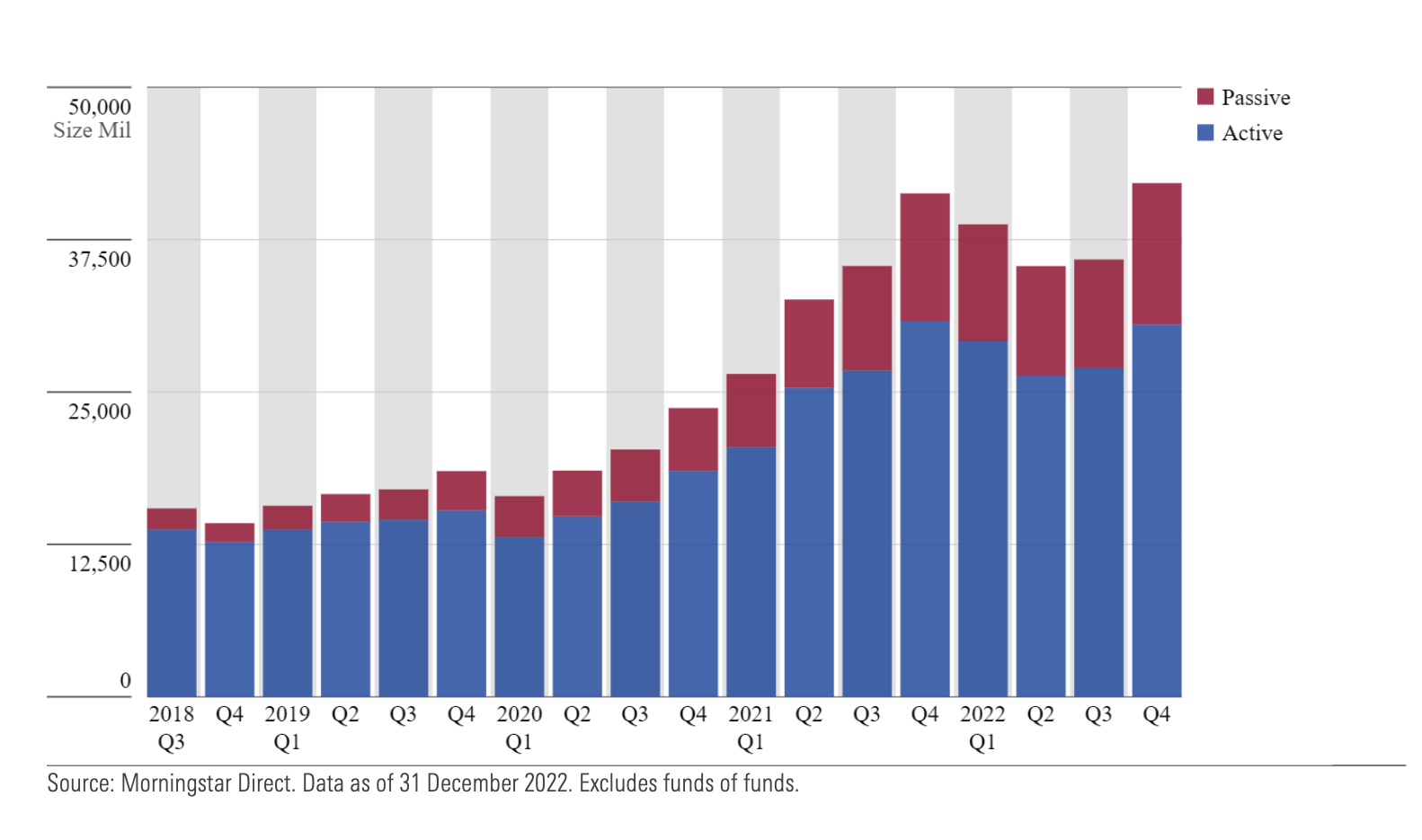

However, it remains tempting for asset managers to greenwash. Asset managers typically seek to gather assets, and fees earned are often based on the volume of funds under management, so it makes sense that they would want to capture funds that are being deployed into sustainable investing. There is no question of the rising popularity of sustainable investing; we see it in Morningstar's data, and each quarter new products are launched and more capital is deployed into sustainable strategies.

Exhibit 1: Aggregate Fund Size of Australasian Sustainable Investments (AUD, Mil)

Greenwashing is defined as making unsubstantiated or misleading claims about the sustainability characteristics and benefits of a company or a managed investment product. Greenwashing is seen as intentional, occurring when asset managers overclaim and oversell their green credentials. However, sometimes greenwashing may not be intentional but instead result from differing definitions of sustainability and/or a mismatch between an investor's expectations and the specific approach used by a sustainable investment fund.

Certainly, a lack of clarity around what constitutes a green investment doesn’t help. There is no universal, accepted standard for sustainable investing. It is estimated there is upward of more than 200 different ESG taxonomies in existence, which can make it difficult to undertake meaningful comparisons and to ascertain the extent of a fund's greenness.

ASIC helped to provide clarity to the local industry by releasing an information sheet targeted at superannuation and managed fund issuers on how to avoid greenwashing when offering or promoting sustainability-related products.

The industry has responded. In 2022, we saw some asset managers and superannuation funds walk away from their involvement in organisations that require certain green commitments and milestones to be met, which they did not feel were achievable. Examples of this include Australian industry super fund CBUS' withdrawal from the Glasgow Finance Alliance for Net Zero, or GFANZ, to focus on internal climate change activities, and Vanguard’s withdrawal from the Net Zero Asset Managers initiative, a subset of GFANZ, in 2022. It is likely there will be more departures from similar alliances in the future.

The Rise of Greenhushing

When engaging with asset managers, Morningstar has recently seen a softening of language around green claims. An unintended consequence of the focus on greenwashing has likely contributed to the rise of greenhushing, which is the antithesis of greenwashing.

To the uninitiated, greenhushing is when firms chose to go incognito, and they underreport or hide their green credentials from the public. Why would they do this? Whilst it seems incongruous at first glance, there are various reasons, such as simply underpromising and overdelivering to investors. After all, it is almost impossible to please all the people all the time, and the more you raise your head above the pulpit, the more you risk getting your head chopped off. Further, as investing sustainably has become contentious in some circles, greenhushing is a way to fly under the radar and escape backlash from those who see sustainable investing as a modern-day example of woke capitalism.

However, greenhushing is suboptimal, it is important to be transparent about intentions and implementation, green or otherwise. Whilst transparency helps investors make informed decisions about where to invest, it also helps raise the bar amongst industry peers. Peer relativities matter across all aspects of investing, not just when comparing performance or asset-allocation decisions but also in relation to green credentials.

What we know for certain is Australian regulators are focused on ensuring appropriate deployment of capital and that green claims made by asset managers must be backed by evidence. The temptation to overreach and exaggerate could cost investment-product providers dearly in a hit to reputation and to the hip pocket via monetary fines.

All in all, the increased focus on greenwashing is good for the industry, as it should help to provide confidence to investors seeking sustainable investments as to whether those claims purported are indeed accurate. However, greenhushing is a phenomenon to watch closely, as it is also detrimental to the transparency and credibility of the investment management industry as it pertains to sustainability.

Look out for our Unpacking ESG series which starts next month.